John Wiley & Sons Limited

Все книги издательства John Wiley & Sons LimitedCompeting for Capital. Investor Relations in a Dynamic World

Praise for Competing for Capital «An indispensable guide for investor relations and communication counselors alike. With more individual investors in the market than ever before, this book makes navigating the new regulatory playing field much more possible–and makes clear the path to victory.» –Michael W. Robinson Director, Levick Strategic Communications; Former Director of Public Affairs and Policy, U.S. Securities and Exchange Commission (SEC); Director of Media Relations, NASD «More than simply writing a textbook on IR, Bruce Marcus shares his wealth of experience and critical viewpoint with those seeking to understand a fast-changing profession.» –June Filingeri President of Comm-Partners LLC, Investor Relations Consultant, and Educator «Bruce Marcus puts some solid ground under the shifting landscape of being an investor relations professional. A must-read primer for public companies.» –Robert C. Roeper Managing Director, VIMAC Ventures, LLC «As the song lyrics go, 'everything old is new again,' but this time with a vengeance. Disclosure has always been the touchstone of securities laws, but now more disclosure is required on a real-time basis with heightened accountability. Competing for Capital is a must-read for those in the securities industry, providing insights into securities markets, the information age and technology, and their impact on the job of investor relations professionals. Investors come in all shapes and sizes from around the globe, and investor relations personnel have their work cut out for them to provide clear, comprehensible, and comprehensive information, accessible to the novice and sophisticate alike. Competing for Capital shows them the way.» –Donna L. Brooks, Esq. Partner, Shipman & Goodwin, LLP «Competing for Capital puts our recent turbulent financial marketplace in context, provides solid information for both new and experienced investor relations practitioners, and offers insights into the future of IR–all in Bruce Marcus's easy-reading style.» –Dixie Watterson IR consultant, Communica Partners «Competing for Capital aptly illustrates how investor relations has become a major corporate responsibility in generating trust, and how the profession must realize now more than ever that the needs of investors have changed because of technology, regulation, and globalization.» –Mark Kollar Managing Director, Cubitt Jacobs & Prosek

Performance Management. Integrating Strategy Execution, Methodologies, Risk, and Analytics

Praise for Praise for Performance Management: Integrating Strategy Execution, Methodologies, Risk, and Analytics «A highly accessible collection of essays on contemporary thinking in performance management. Readers will get excellent overviews on the Balanced Scorecard, strategy maps, incentives, management accounting, activity-based costing, customer lifetime value, and sustainable shareholder value creation.» —Robert S. Kaplan, Harvard Business School; coauthor of The Balanced Scorecard: Translating Strategy into Action, The Execution Premium, and many other books «Gary Cokins demonstrates in this book that performance management is not a mysterious black art, but a structured, process-oriented discipline. If you want your performance management system to be a smoothly running analytical machine, read and apply the ideas in this book—it's all you need.» —Thomas H. Davenport, President's Distinguished Professor of Information Technology and Management, Babson College; coauthor of Competing on Analytics: The New Science of Winning «Drawing on a deep reservoir of knowledge and experience gained from hundreds of customer engagements around the world, Gary Cokins offers an authoritative examination of the major dimensions of performance management. Cokins not only paints a rich and textured view of the major principles and concepts driving performance management implementations, he offers a nuanced look at the important subtleties that can spell the difference between success and failure. This is an informative and enjoyable text to read!» —Wayne Eckerson, Director of Research, The Data Warehouse Institute (TDWI); author of Performance Dashboards: Measuring, Monitoring, and Managing Your Business «[In this] very insightful book, the view of an integrated performance management framework with a goal to link various operational activities with business strategy is an excellent approach to manage and improve business. Gary's explanation of risk-based performance management, for providing the capability to achieve long-term objectives with reliably calculated risks, is definitely thought provoking.» —Srini Pallia, Global Head and Vice President of Business Technology Services, Wipro Technologies, Bangalore, India «Gary Cokins is clearly one of the world's thought leaders in the area of performance management, and the need for integrated performance management, improvement and execution is clearly at a premium in these challenging economic times. This book is a must read for CEOs, CFOs, and management accountants around the globe seeking higher levels of sustainable business performance for their stakeholders.» —Jeffrey C. Thomson, President and CEO, Institute of Management Accountants

Convertible Arbitrage. Insights and Techniques for Successful Hedging

Minimize risk and maximize profits with convertible arbitrage Convertible arbitrage involves purchasing a portfolio of convertible securities-generally convertible bonds-and hedging a portion of the equity risk by selling short the underlying common stock. This increasingly popular strategy, which is especially useful during times of market volatility, allows individuals to increase their returns while decreasing their risks. Convertible Arbitrage offers a thorough explanation of this unique investment strategy. Filled with in-depth insights from an expert in the field, this comprehensive guide explores a wide range of convertible topics. Readers will be introduced to a variety of models for convertible analysis, «the Greeks,» as well as the full range of hedges, including titled and leveraged hedges, as well as swaps, nontraditional hedges, and option hedging. They will also gain a firm understanding of alternative convertible structures, the use of foreign convertibles in hedging, risk management at the portfolio level, and trading and hedging risks. Convertible Arbitrage eliminates any confusion by clearly differentiating convertible arbitrage strategy from other hedging techniques such as long-short equity, merger and acquisition arbitrage, and fixed-income arbitrage. Nick Calamos (Naperville, IL) oversees research and portfolio management for Calamos Asset Management, Inc. Since 1983 his experience has centered on convertible securities investment. He received his undergraduate degree in economics from Southern Illinois University and an MS in finance from Northern Illinois University.

Fleeting Rome. In Search of la Dolce Vita

Only a renaissance man could have described this glorious city in its heyday. And only Carlo Levi, writer, painter, politician and one of the last century's most celebrated talents, could depict Rome at the height of its optimism and vitality after World War II. In Fleeting Rome, the era of post war 'La Dolce Vita' is brought magnificently to life in the daily bustle of Rome's street traders, housewives and students at work and play, the colourful festivities of Ferragosto and San Giovanni, the little theatre of Pulcinella al Pincio; all vibrant sights and sounds of this ancient, yet vital city.

Eisenhower on Leadership. Ike's Enduring Lessons in Total Victory Management

Based on the findings in recently released archive papers and letters, as well as extensive library and historical resources, Alan Axelrod offers a compelling profile of the remarkable leadership discipline of a general often called a «military CEO.» In fascinating detail, Axelrod reveals that Ike was more than a great military leader; he was also a great executive who could—and did—write a reassuring letter to the mother of a solider one moment and make decisions impacting millions of lives the next. Follow Ike's path as Supreme Commander from the invasion of North Africa to victory in Europe and learn the lessons of great leadership along the way, including: The nature of leadership Managing detail without sacrificing the “big picture” Ensuring follow-through to execution Building a team Converting conflict into common cause Getting the facts and making plans Mentoring, motivating, and inspiring

Unleashing Innovation. How Whirlpool Transformed an Industry

In publications such as BusinessWeek and Fast Company, the media have celebrated Whirlpool's transformation into a leading-edge innovator and Nancy Tennant Snyder's role as chief innovation officer. Ten years after this remarkable transformation, Unleashing Innovation tells the inside story of one of the most successful innovation turnarounds in American history. Nancy Tennant Snyder and coauthor Deborah L. Duarte reveal how Whirlpool undertook one of the largest change efforts in corporate history and show how innovation was embedded throughout the company, which ultimately lead to bottom-line results.

Wisdom on Value Investing. How to Profit on Fallen Angels

Wisdom on Value Investing offers author Gabriel Wisdom's insights on succeeding in difficult markets. One of his favorite approaches-which is part classic value investing and part behavioral finance-is called «The Fallen Angels Investment Strategy,» and it prepares investors to look past short-term value assumptions in order to capture profits. Throughout this book, Wisdom will show you how to capitalize on value plays where the fundamentals are actually strong, but the «general wisdom» surrounding the security has turned negative. He discusses how stocks with the most promise are ones that Wall Street has marked down without regard to their underlying value, and reveals how this type of intrinsic value discount provides a margin of safety during difficult times, and substantial upside rewards for those who find them early enough. Takes value investing one step further by mixing significant amounts of behavioral finance into the analysis Prepares investors to take advantage of other's mistakes A time-tested strategy for any type of market-up or down A classic look at value investing with a twist, this book will put you in a better position to succeed in both bull and bear markets. Includes a Foreword by Mary Buffett and David Clark, authors of Buffettology.

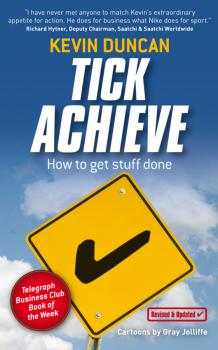

Tick Achieve. How to Get Stuff Done

How many times have you thought of something crucial to do and then forgotten it completely? That's why people invented lists. And very useful they are too. If, and only if, they are used effectively. Put thirty things on a list, and it becomes too daunting. Put three things on, and there's no point in having a list. And so we have refined the art of list writing to allow for about ten or twenty things to do. But in truth, most lists are rubbish. Randomly assembled, they do little to help the author navigate their way through the maze of stuff to do. After all, the only point of a list of things to do, is to get things done. Tick Achieve does just that. It shows you how to get stuff done, with lots of little techniques tried and tested on scores of individuals over 25 years. This includes the cathartic and highly effective process of writing a list of what you are not going to do. The author has trained hundreds of people in the art of getting stuff done. There is no Big Plan as such (contrary to what many other books suggest). It's all about details, and they can be very easy to implement. Little things can make a massive difference. Once you get the hang of it, life gets easier. In a business context, and personally. You can sleep better and worry less. Concentrate on the things that matter, and leave out the trivia and irrelevant. Learn how to celebrate little bits of progress, look down your list, tick off a job well done, and shout Tick Achieve! EXAMPLE CHAPTER OUTLINE 1. BUSINESS INTELLIGENCE «I'm too busy, I'm in a meeting»: professional time wasting and how to avoid it Teams; what's the point? The problem with the business world: other people How to think more and worry less How being organised lets you take it easy Action not activity Outcome not output "If I do x, then y will happen…' 2. STRAIGHT TALKING AND GETTING STUFF DONE Permission to talk straight Cliché and jargon red alert list How to get to the point and get everything done quickly Some ways to say no politely How to liven up boring meetings Spotting business bull**** Cutting through it and moving on 3. LEAVE IT OUT Less really is more How eliminating issues gets to faster answers in business Write a list of what you are not going to do Improving your time management Simplifying everything Being totally objective about the past How leaving it out forces the issue 4. ONE IN A ROW How breaking big problems down into small tasks really works How to eat an elephant – in stages Knock 'em down one at a time Rapid sequential tasking: an alternative to multi-tasking The one-touch approach Tick, achieve, move on 5. LOOK LIVELY! The value of energy: in business, and in life generally Getting your attitude right Why lazy people are unhappy people Speed, that's the thing Spotting pointless people Ditching the time wasters Don't waste time yourself: beware aimless net surfers Cuttin

The Compensation Solution. How to Develop an Employee-Driven Rewards System

Money isn't everything to today's employees. This book shows companies how to combine traditional compensation with the educational, emotional, and psychological benefits that will attract the best and brightest. It identifies the ten elements–including learning, advancement, emotional rewards, and quality of life–that job seekers rank highest among desired benefits. Then it shows employers how to combine them with monetary benefits to create effective, employee-driven compensation packages.

Herd. How to Change Mass Behaviour by Harnessing Our True Nature

"…fascinating. Like Malcolm Gladwell on speed." —THE GUARDIAN «HERD is a rare thing: a book that transforms the reader's perception of how the world works». —Matthew D'Ancona, THE SPECTATOR «This book is a must. Once you have read it you will understand why Mark Earls is regarded as a marketing guru.» —Daniel Finkelstein, THE TIMES This paperback version of Mark Earls' groundbreaking and award winning book comes updated with new stats and figures and provides two completely revised chapters that deal with the rise of social networking. Since the Enlightenment there has been a very simple but widely held assumption that we are a species of thinking individuals and human behaviour is best understood by examining the psychology of individuals. It appears, however, that this insight is plain wrong. The evidence from a number of leading behavioural and neuroscientists suggests that our species is designed as a herd or group animal. Mark Earls applies this evidence to the traditional mechanisms of marketing and consumer behaviour, with a result that necessitates a complete rethink about these subjects. HERD provides a host of unusual examples and anecdotes to open the mind of the business reader, from Peter Kay to Desmond Tutu, Apple to UK Sexual Health programmes, George Bush to Castle Lager, from autism to depression to the real explanation for the placebo effect in pharmaceutical testing.