Экономика

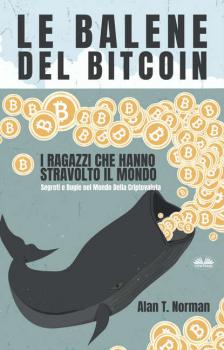

Различные книги в жанре ЭкономикаLe Balene Del Bitcoin

Se vuoi immergerti nel mondo reale, non virtuale, di animali meravigliosi, tutto ciò che devi fare è investire una parte del tuo capitale nel mercato delle criptovalute. Qui troverai molti animali: balene, squali e persino criceti. Il tuo ruolo in questo favoloso zoo dipende da molti fattori. È improbabile che tu possa far fronte solo a uno dei ruoli principali: il ruolo di una balena. Se vuoi immergerti nel mondo reale, non virtuale, di animali meravigliosi, tutto ciò che devi fare è investire una parte del tuo capitale nel mercato delle criptovalute. Qui troverai molti animali: balene, squali e persino criceti. Il tuo ruolo in questo favoloso zoo dipende da molti fattori. È improbabile che tu possa far fronte solo a uno dei ruoli principali: il ruolo di una balena. Quindi chi sono le balene e perché sono così speciali? Le balene sono i principali detentori di criptovalute e possiedono un capitale molto grande. Non solo grande, ma MOLTO grande. Suppongo che non vedrai nulla di soprannaturale in questo argomento, dal momento che tali attori esistono anche nei mercati tradizionali. E tu li conosci? Non posso fare a meno di essere d'accordo con te su questo argomento. Tuttavia, c'è ancora una grande differenza tra le balene, diciamo nel mercato azionario e le balene nel mercato delle criptovalute. Se i primi vivono in un chiaro quadro giuridico e giocano solo secondo determinate regole, i secondi, a causa della novità e dell'azzardo nel mercato delle criptovalute, fanno quello che vogliono, quando vogliono e con chi vogliono. In altre parole, questi animali apparentemente carini del mondo sottomarino commettono semplicemente manipolazioni brutali e ciniche sul mercato. È quasi impossibile rintracciare le loro azioni e ancor più punirle. Finché non ci saranno regolatori sul mercato, ciascuno dei suoi partecipanti continuerà a svolgere il proprio ruolo: qualcuno stabilirà le regole, determinando l'ulteriore movimento di un prezzo in valuta, mentre altri si adatteranno. Il mio libro fornisce una prova al cento per cento dell'indignazione verso le balene? No non lo fa! Il mio libro suggerisce i modi in cui affrontarli? No non lo fa! Potresti chiedere: perché allora ho bisogno di questo libro? – Per distruggere la mia fiducia nel luminoso futuro della nuova era della moneta elettronica? No! La mia missione è semplice: rivelarti i fatti interiori del mondo delle criptovalute. Sta a te decidere cosa fare con queste informazioni. Non dimenticare che chi possiede le informazioni, possiede il mondo. La mia indagine ti fornirà solo le relazioni di causa ed effetto tra questi o altri partecipanti al mercato, vale a dire: * la caratteristica comune dei portafogli che memorizzano centinaia di migliaia di Bitcoin * il significato delle micro transazioni tra questi portafogli e la relazione che hanno con la valuta, – il motivo per cui i token USDT non possono essere acquistati attraverso la banca e il modo in cui quei token, che avrebbero dovuto essere distrutti dopo i prelievi di valuta nazionale, sono tornati su Bitfinex * il motivo per cui i token USDT non possono essere acquistati attraverso la banca e il modo in cui quei token, che avrebbero dovuto essere distrutti dopo i prelievi di valuta nazionale, sono tornati su Bitfinex. Ma … Questo libro non parla solo di una cospirazione globale. Riguarda la speranza recentemente restituita nella persona del creatore di Bitcoin, che tutti conosciamo sotto il nome di Satoshi Nakamoto. Ti presenterò il vero padre della criptovaluta nelle pagine di questo libro. Vorrei finire la mia storia con le parole di Shakespeare: ”Il mondo intero – il teatro e le persone in esso – gli attori”. Bene, bene … Forse, Shakespeare allora voleva metterci in guardia su qualcosa?

A Guide to Business Statistics

An accessible text that explains fundamental concepts in business statistics that are often obscured by formulae and mathematical notation A Guide to Business Statistics offers a practical approach to statistics that covers the fundamental concepts in business and economics. The book maintains the level of rigor of a more conventional textbook in business statistics but uses a more streamlined and intuitive approach. In short, A Guide to Business Statistics provides clarity to the typical statistics textbook cluttered with notation and formulae. The author—an expert in the field—offers concise and straightforward explanations to the core principles and techniques in business statistics. The concepts are introduced through examples, and the text is designed to be accessible to readers with a variety of backgrounds. To enhance learning, most of the mathematical formulae and notation appears in technical appendices at the end of each chapter. This important resource: • Offers a comprehensive guide to understanding business statistics targeting business and economics students and professionals • Introduces the concepts and techniques through concise and intuitive examples • Focuses on understanding by moving distracting formulae and mathematical notation to appendices • Offers intuition, insights, humor, and practical advice for students of business statistics • Features coverage of sampling techniques, descriptive statistics, probability, sampling distributions, confidence intervals, hypothesis tests, and regression Written for undergraduate business students, business and economics majors, teachers, and practitioners, A Guide to Business Statistics offers an accessible guide to the key concepts and fundamental principles in statistics. DAVID M. McEVOY, PhD, is an Associate Professor in the Economics Department at Appalachian State University in Boone NC. He has published over 20 peer-reviewed articles and is coeditor of two books. Dr. McEvoy is an award-winning educator who has taught undergraduate courses in business statistics for over 10 years. DAVID M. McEVOY, PhD, is an Associate Professor in the Economics Department at Appalachian State University in Boone NC. He has published over 20 peer-reviewed articles and is coeditor of two books. Dr. McEvoy is an award-winning educator who has taught undergraduate courses in business statistics for over 10 years.An accessible text that explains fundamental conceptsin business statistics that are often obscured by formulae and mathematical notationA Guide to Business Statistics offers a practical approach to statistics that covers the fundamental concepts in business and economics. The book maintains the level of rigor of a more conventional textbook in business statistics but uses a more streamlined and intuitive approach. In short, A Guide to Business Statistics provides clarity to the typical statistics textbook cluttered with notation and formulae.The author—an expert in the field—offers concise and straightforward explanations to the core principles and techniques in business statistics. The concepts are introduced through examples, and the text is designed to be accessible

New Capitalism?

In this stimulating and highly original work, Kevin Doogan looks at contemporary social transformation through the lens of the labour market. Major themes of the day – globalization, technological change and the new economy, the pension and demographic timebombs, flexibility and traditional employment – are all subject to critical scrutiny. We are often told that a new global economy has emerged which has transformed our lives. It is argued that the pace of technological change, the mobility of multinational capital and the privatization of the welfare state have combined to create a more precarious world. Companies are outsourcing, jobs are migrating to China and India, and a job for life is said to be a thing of the past. The so-called ‘new capitalism’ is said to be the result of these profound changes. Kevin Doogan takes issue with these widely-accepted ideas and subjects the transformation of work to detailed examination through a comprehensive analysis of developments in Europe and North America. He argues that precariousness is not a natural consequence of this fast-changing world; rather, current insecurities are manufactured, emanating from neoliberal policy and the greater exposure of the economy to market forces. New Capitalism? The Transformation of Work is sure to stimulate academic debate. Kevin Doogan's account will appeal not just to scholars, but also to upper-level students across the social sciences, including the sociology of work, industrial relations, globalization, economics, social policy and business studies.

Operational Risk

Discover how to optimize business strategies from both qualitative and quantitative points of view Operational Risk: Modeling Analytics is organized around the principle that the analysis of operational risk consists, in part, of the collection of data and the building of mathematical models to describe risk. This book is designed to provide risk analysts with a framework of the mathematical models and methods used in the measurement and modeling of operational risk in both the banking and insurance sectors. Beginning with a foundation for operational risk modeling and a focus on the modeling process, the book flows logically to discussion of probabilistic tools for operational risk modeling and statistical methods for calibrating models of operational risk. Exercises are included in chapters involving numerical computations for students' practice and reinforcement of concepts. Written by Harry Panjer, one of the foremost authorities in the world on risk modeling and its effects in business management, this is the first comprehensive book dedicated to the quantitative assessment of operational risk using the tools of probability, statistics, and actuarial science. In addition to providing great detail of the many probabilistic and statistical methods used in operational risk, this book features: * Ample exercises to further elucidate the concepts in the text * Definitive coverage of distribution functions and related concepts * Models for the size of losses * Models for frequency of loss * Aggregate loss modeling * Extreme value modeling * Dependency modeling using copulas * Statistical methods in model selection and calibration Assuming no previous expertise in either operational risk terminology or in mathematical statistics, the text is designed for beginning graduate-level courses on risk and operational management or enterprise risk management. This book is also useful as a reference for practitioners in both enterprise risk management and risk and operational management.

Conflict and Cooperation

Allan Schmid’s innovative text, Conflict and Cooperation: Institutional and Behavioral Economics,investigates «the rules of the game,» how institutions–both formal and informal–affect these rules, and how these rules are changed to serve competing interests. This text addresses both formal and informal institutions and the impact of alternative institutions, as well as institutional change and evolution. With its broad applications and numerous practice and discussion questions, this book will be appealing not only to students of economics, but also to those studying sociology, law, and political science. Addresses formal and informal institutions, the impact of alternative institutions, and institutional change and evolution. Presents a framework open to changing preferences, bounded rationality, and evolution. Explains how to form empirically testable hypotheses using experiments, case studies, and econometrics. Includes numerous practice and discussion questions.

Actuarial Theory for Dependent Risks

The increasing complexity of insurance and reinsurance products has seen a growing interest amongst actuaries in the modelling of dependent risks. For efficient risk management, actuaries need to be able to answer fundamental questions such as: Is the correlation structure dangerous? And, if yes, to what extent? Therefore tools to quantify, compare, and model the strength of dependence between different risks are vital. Combining coverage of stochastic order and risk measure theories with the basics of risk management and stochastic dependence, this book provides an essential guide to managing modern financial risk. * Describes how to model risks in incomplete markets, emphasising insurance risks. * Explains how to measure and compare the danger of risks, model their interactions, and measure the strength of their association. * Examines the type of dependence induced by GLM-based credibility models, the bounds on functions of dependent risks, and probabilistic distances between actuarial models. * Detailed presentation of risk measures, stochastic orderings, copula models, dependence concepts and dependence orderings. * Includes numerous exercises allowing a cementing of the concepts by all levels of readers. * Solutions to tasks as well as further examples and exercises can be found on a supporting website. An invaluable reference for both academics and practitioners alike, Actuarial Theory for Dependent Risks will appeal to all those eager to master the up-to-date modelling tools for dependent risks. The inclusion of exercises and practical examples makes the book suitable for advanced courses on risk management in incomplete markets. Traders looking for practical advice on insurance markets will also find much of interest.

The Hopes and Dreams of Libby Quinn

A gorgeous new romantic comedy about taking chances and realising your dreams. Libby Quinn is sick and tired of being sensible. After years of slogging her guts out for nothing at a PR company, she finds herself redundant and about to plough every last penny of her savings into refurbishing a ramshackle shop and making her dream of owning her own bookshop become a reality.She hopes opening 'Once Upon A Book' on Ivy Lane will be the perfect tribute to her beloved grandfather who instilled a love of reading and books in her from an early age.When her love life and friendships become even more complicated – will Libby have the courage to follow her dreams? Or has she bitten off more than she can chew?