John Wiley & Sons Limited

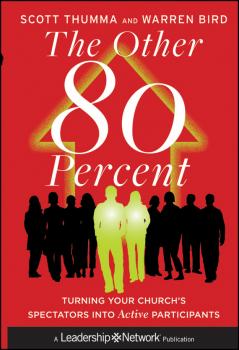

Все книги издательства John Wiley & Sons LimitedThe Other 80 Percent. Turning Your Church's Spectators into Active Participants

A research-based approach to developing more active and involved congregations In this practical resource, well-known and respected researcher Scott Thumma and professional co-writer Warren Bird draw upon new and heretofore unpublished research across a broad range of Protestant churches of all sizes and show how to create more active members. Offers solid information of what church leaders need to know about the factors and practices that create church members who are more actively and passionately involved in their congregations. Offers a first of its kind resource for developing engaged congregations Lead author Scott Thumma is a noted researcher and writer on congregational studies Warren Bird is coauthor of Culture Shift and Viral Churches This book offers advice for moving church members from being spectators to living a life of discipleship and faith.

The Profit Principle. Turn What You Know Into What You Do - Without Borrowing a Cent!

The profit principle is the only secret to good business you'll ever need to know. Success in business has little to do with investment capital, a business plan or office space. Success comes from applying the four-part profit principle. Discover how you can turn what you know into what you do, and launch a successful, sustainable venture without spending (or borrowing) a cent. It’s a process that's simpler than you think and already within reach. Most books on starting a business don't extend further than the practicalities: plans, finance, accounting, equipment and so on. There are so many books on this topic, and their advice is often similar and predictable; rarely do they offer a new perspective or directions for a smarter approach. The motivational books that also serve this market may read well, but they often lack the substance on which to base sound business decisions and actions. If you want to run your own business and don't already, stop and ask yourself why not? The Profit Principle is a modern classic that will revolutionise your thinking on what it takes to succeed and inspire you to get started.

The Little Book of Trading. Trend Following Strategy for Big Winnings

How to get past the crisis and make the market work for you again The last decade has left people terrified of even the safest investment opportunities. This fear is not helping would-be investors who could be making money if they had a solid plan. The Little Book of Trading teaches the average person rules and philosophies that winners use to beat the market, regardless of the financial climate. The market has always fluctuated, but savvy traders know how to make money in good times and bad. Drawing on author Michael Covel's own trading experience, as well as insights from legendary traders, the book offers sound, practical advice in an easy to understand, readily digestible way. The Little Book of Trading: Identifies tools, concepts, psychologies, and philosophies that keep people protected and making money when the next market bubble or surprise crisis occurs Features top traders in each chapter that have beaten the market for decades, providing readers with their moneymaking knowledge Shows how traders who beat mutual fund performance make money at different times, not just from stocks alone Most importantly, The Little Book of Trading explains why mutual funds should not be the investment vehicle of choice for people looking to secure retirement, a radical realization highlighting the changed face of investing today.

The Handbook of Equity Market Anomalies. Translating Market Inefficiencies into Effective Investment Strategies

Investment pioneer Len Zacks presents the latest academic research on how to beat the market using equity anomalies The Handbook of Equity Market Anomalies organizes and summarizes research carried out by hundreds of finance and accounting professors over the last twenty years to identify and measure equity market inefficiencies and provides self-directed individual investors with a framework for incorporating the results of this research into their own investment processes. Edited by Len Zacks, CEO of Zacks Investment Research, and written by leading professors who have performed groundbreaking research on specific anomalies, this book succinctly summarizes the most important anomalies that savvy investors have used for decades to beat the market. Some of the anomalies addressed include the accrual anomaly, net stock anomalies, fundamental anomalies, estimate revisions, changes in and levels of broker recommendations, earnings-per-share surprises, insider trading, price momentum and technical analysis, value and size anomalies, and several seasonal anomalies. This reliable resource also provides insights on how to best use the various anomalies in both market neutral and in long investor portfolios. A treasure trove of investment research and wisdom, the book will save you literally thousands of hours by distilling the essence of twenty years of academic research into eleven clear chapters and providing the framework and conviction to develop market-beating strategies. Strips the academic jargon from the research and highlights the actual returns generated by the anomalies, and documented in the academic literature Provides a theoretical framework within which to understand the concepts of risk adjusted returns and market inefficiencies Anomalies are selected by Len Zacks, a pioneer in the field of investing As the founder of Zacks Investment Research, Len Zacks pioneered the concept of the earnings-per-share surprise in 1982 and developed the Zacks Rank, one of the first anomaly-based stock selection tools. Today, his firm manages U.S. equities for individual and institutional investors and provides investment software and investment data to all types of investors. Now, with his new book, he shows you what it takes to build a quant process to outperform an index based on academically documented market inefficiencies and anomalies.

Social Business By Design. Transformative Social Media Strategies for the Connected Company

From the Dachis Group—the global leader in social business—comes the groundbreaking book on transformative social business strategies. Social Business By Design is the definitive management book on how to rethink the modern organization in the social media era. Based on their research and work through the Dachis Group, thought leaders Dion Hinchcliffe and Peter Kim deftly explore how the social, cultural, and technological trends provoked by the social media explosion are transforming the business environment. Designed as both a strategic overview and a hands-on resource, Social Business By Design clearly shows how to choose and implement a social business strategy and maximize its impact. Explains the mechanisms, applications, and advantages of a strategic array of social media topics, including social media marketing, social product development, crowdsourcing, social supply chains, social customer relationship management, and more Features examples from high-profile companies such as SAP, Procter & Gamble, MillerCoors, Bloomberg, HBO, Ford, and IBM who have implemented social business strategies Draws on the extensive research and expertise of the Dachis Group, which has helped numerous Fortune 500 clients plan, build, and activate effective social business solutions Containing actionable, high-impact techniques that save time and the bottom line, Social Business By Design will transform any organization's strategy to ensure success and avoid disruption in a fast-moving world.

The Art of Being Brilliant. Transform Your Life by Doing What Works For You

A pep talk in your pocket This short, small, highly illustrated book will fill you to the brim with happiness, positivity, wellbeing and, most importantly, success! Andy Cope and Andy Whittaker are experts in the art of happiness and positive psychology and The Art of Being Brilliant is crammed full of good advice, instructive case studies, inspiring quotes, some funny stuff and important questions to make you think about your work, relationships and life. You see being brilliant, successful and happy isn’t about dramatic change, it’s about finding out what really works for you and doing more of it! The authors lay down their six common-sense principles that will ensure you focus on what you’re good at and become super brilliant both at work and at home. • A richly illustrated, 2 colour, small book full of humour, inspiring quotes and solid advice • A great read with a serious underlying message – how to foster positivity and bring about success in every aspect of your life • Outlines six common-sense principles that will help you ensure you are the best you can be

Business Models for the Social Mobile Cloud. Transform Your Business Using Social Media, Mobile Internet, and Cloud Computing

Fully exploit new conditions and opportunities created by current technological changes The combined impact of social technologies, the mobile Internet, and cloud computing are creating incredible new business opportunities. They are also destroying unprepared companies, transforming industries, and leaving behind workers who are unwilling or unable to adapt. Business Models for the Social Mobile Cloud reveals a compelling view from PwC of how the social mobile cloud and a combination of new technology changes are key players in a digital transformation in business and society that is moving more quickly and cutting more deeply than any technology transformation ever seen. Explores a road map to success through adapting to technological changes Written for businesses and leaders who want to understand how the coming technology changes will eventually impact their businesses For companies to succeed, leaders must understand how to stay ahead of their competitors in adapting to the new conditions and opportunities. In Business Models for the Social Mobile Cloud, PwC’s Ted Shelton describes the tectonic changes currently underway—and to come—plus why they are happening, what to expect, and what you must do about.

Credit Derivatives. Trading, Investing,and Risk Management

The credit derivatives industry has come under close scrutiny over the past few years, with the recent financial crisis highlighting the instability of a number of credit structures and throwing the industry into turmoil. What has been made clear by recent events is the necessity for a thorough understanding of credit derivatives by all parties involved in a transaction, especially traders, structurers, quants and investors. Fully revised and updated to take in to account the new products, markets and risk requirements post financial crisis, Credit Derivatives: Trading, Investing and Risk Management, Second Edition, covers the subject from a real world perspective, tackling issues such as liquidity, poor data, and credit spreads, to the latest innovations in portfolio products, hedging and risk management techniques. The book concentrates on practical issues and develops an understanding of the products through applications and detailed analysis of the risks and alternative means of trading. It provides: a description of the key products, applications, and an analysis of typical trades including basis trading, hedging, and credit structuring; analysis of the industry standard 'default and recovery' and Copula models including many examples, and a description of the models' shortcomings; tools and techniques for the management of a portfolio or book of credit risks including appropriate and inappropriate methods of correlation risk management; a thorough analysis of counterparty risk; an intuitive understanding of credit correlation in reality and in the Copula model. The book is thoroughly updated to reflect the changes the industry has seen over the past 5 years, notably with an analysis of the lead up and causes of the credit crisis. It contains 50% new material, which includes copula valuation and hedging, portfolio optimisation, portfolio products and correlation risk management, pricing in illiquid environments, chapters on the evolution of credit management systems, the credit meltdown and new chapters on the implementation and testing of credit derivative models and systems. The book is accompanied by a website which contains tools for credit derivatives valuation and risk management, illustrating the models used in the book and also providing a valuation toolkit.

The Part-Time Trader. Trading Stock as a Part-Time Venture, + Website

Practical advice and easy-to-follow guidelines for part-time stock traders Millions of people trade stocks in their spare time, supplementing their nine-to-five income with extra profits on the market. And while there are plenty of books on the market that cater to the needs of full-time traders, there are precious few that focus on the trading strategies that are best suited for part-time traders who must balance the demands of other responsibilities while successfully navigating a changing and dynamic stock market. This handy guide equips part-time traders with all the necessary tools for successful trading—including guidance on pre-market/pre-work studies and how to make profitable trades without interfering with one's day job. The Part-Time Trader focuses entirely on those trading strategies best suited for part-timers, making trading both simpler and more profitable. One of the few books on trading intended and designed specifically for part-time traders with other jobs or responsibilities Includes online access to the author's proprietary trading system that offers easy-to-follow guidelines for traders who can't spend all day watching the markets Written by the co-founder of SharePlanner Inc., a popular financial website devoted to day-trading, swing-trading (both long and short), and exchange-traded funds For part-time traders who can't dedicate all their time to watching the markets and reading charts, The Part-Time Trader offers straightforward, profitable trading advice.

Trading VIX Derivatives. Trading and Hedging Strategies Using VIX Futures, Options, and Exchange Traded Notes

A guide to using the VIX to forecast and trade markets Known as the fear index, the VIX provides a snapshot of expectations about future stock market volatility and generally moves inversely to the overall stock market. Trading VIX Derivatives will show you how to use the Chicago Board Options Exchange's S&P 500 volatility index to gauge fear and greed in the market, use market volatility to your advantage, and hedge stock portfolios. Engaging and informative, this book skillfully explains the mechanics and strategies associated with trading VIX options, futures, exchange traded notes, and options on exchange traded notes. Many market participants look at the VIX to help understand market sentiment and predict turning points. With a slew of VIX index trading products now available, traders can use a variety of strategies to speculate outright on the direction of market volatility, but they can also utilize these products in conjunction with other instruments to create spread trades or hedge their overall risk. Reviews how to use the VIX to forecast market turning points, as well as reveals what it takes to implement trading strategies using VIX options, futures, and ETNs Accessible to active individual traders, but sufficiently sophisticated for professional traders Offers insights on how volatility-based strategies can be used to provide diversification and enhance returns Written by Russell Rhoads, a top instructor at the CBOE's Options Institute, this book reflects on the wide range of uses associated with the VIX and will interest anyone looking for profitable new forecasting and trading techniques.