Управление, подбор персонала

Различные книги в жанре Управление, подбор персоналаFinance for Strategic Decision-Making. What Non-Financial Managers Need to Know

Finance for Strategic Decision Making demystifies and clarifies for non-financial executives the basics of financial analysis. It shows how they can make important financial decisions that can critically enhance their institution’s ability to respond to competitive challenges, undertake new projects, overcome financial setbacks, and most importantly, create shareholder value. Written by M. P. Narayanan and Vikram K. Nanda—two of the country’s leading authorities on financial strategy—this book offers a practical guide for using financial analysis to enhance strategicdecision making. The book includes a coherent framework that outlines practical and intellectually sound guidance for executives who must make strategic decisions. Finance for Strategic Decision Making Explains the role of finance in corporate strategy Offers guidance on resource allocation decisions Explores how to determine the right balance of debt and equity capital to maximize firm value Demonstrates how to use payout policy as a strategic tool Clarifies if a merger, acquisition, or divestiture is in the best interest of an organization Shows how to manage risk Reveals how to measure value created and the effectiveness of upper level management

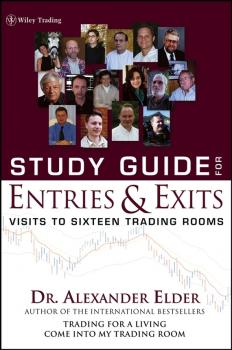

Study Guide for Entries and Exits, Study Guide. Visits to 16 Trading Rooms

These 101 questions, including twenty-five case studies, will challenge you to master the essential aspects of successful trading. Be sure to work through this companion volume to Entries & Exits: Visits to Sixteen Trading Rooms before you risk a dollar in the markets. Each of the seven chapters in this Study Guide for Entries & Exits—Organization, Psychology, Markets, Trading Tactics, Money Management & Record-Keeping, Case Studies, and Traders Speak—covers a major area of trading. Every chapter includes a rating scale, allowing you to measure your competence level. Now, you can discover and fill dangerous gaps in your knowledge without risking any money. The comments in the back of the book provide detailed explanations of the right and wrong answers to the multiple-choice questions. A large number of those questions and the case histories in this Study Guide were contributed by the traders interviewed in Entries & Exits, combining both books into a single, powerful tool for developing effective trading skills. Use Dr. Elder's Study Guide together with Entries & Exits to learn how to make the most of market opportunities.

The Organization of the Future 2. Visions, Strategies, and Insights on Managing in a New Era

With 26 inspiring chapters, this book celebrates the wisdom of some of the most recognized thought leaders of our day: emerging and established experts who share their unique vision of what the organization of the future should look like and must do to survive in the turbulent 21st Century. Outsmart Your Rivals by Seeing What Others Don’t, Jim Champy Organization Is Not Structure but Capability, Dave Ulrich & Norm Smallwood The Leader’s Mandate: Create a Shared Sense of Destiny, James M. Kouzes & Barry Z. Posner A Different Kind of Company, Srikumar S. Rao Free to Choose: How American Managers Can Create Globally Competitive Workplaces, James O’Toole Managing the Whole Mandate for the Twenty-First Century: Ditching the Quick-Fix Approach to Management, Paul Borawski & Maryann Brennan The Values That Build a Strong Organization, Thomas J. Moran Revisiting the Concept of the Corporation, Charles Handy Mobilizing Emotions for Performance: Making the Most of the Informal Organization, Jon R. Katzenbach & Zia Khan Beyond Retirement: Mature Workers Are Essential Talent for Organizations of the Future, Richard J. Leider The Best Hope for Organizations of the Future: A Functioning Society, Ira A. Jackson Reframing Ethics, Spirit, and Soul, Lee G. Bolman &Terrence E. Deal Environment Drives Behavior and Expectations, Bill Strickland with Regina Cronin Dynamic Organizations for an Entrepreneurial Age, Christopher Gergen & Gregg Vanourek Multidimensional, Multinational Organizations of the Future, Jay R. Galbraith Designing Organizations That Are Built to Change, Edward E. Lawler III & Christopher G. Worley Refounding a Movement: Preparing a One-Hundred- Year-Old Organization for the Future, Kathy Cloninger Three Challenges Facing Nonprofits of the Future: People, Funding, and Strategy, Roxanne Spillett Pioneering the College of the Future: Building as We Walk, Darlyne Bailey The Organization of the Future Will Foster an Inclusive Environment, Lee Cockerell The Leader as Subculture Manager, Edgar H. Schein The New High-Performance, Horizontal Organization, Howard M. Guttman The Leadership Blueprint to Achieve Exponential Growth, David G. Thomson Leadership Judgment: The Essence of a Good Leader, Noel M. Tichy & Christopher DeRose The Leader of the Future, William A. Cohen Leadership by Perpetual Practice, Debbe Kennedy

Enhanced Indexing Strategies. Utilizing Futures and Options to Achieve Higher Performance

Leveraged index investments, including index futures, options, and ETFs, are one of the fastest growing products in finance, as both retail and institutional investors are attracted to their long-term returns and capital efficiency. With Enhanced Indexing Strategies, author Tristan Yates reveals how you can create and build high-performance indexing strategies using derivatives that can potentially generate much higher returns than conventional index investing. In addition, Enhanced Indexing Strategies introduces six innovative long-term indexing strategies using futures and options, each with its own advantages and applications.

Divorcing the Dow. Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead

An investment approach that unlocks the secret of market patterns Based on over forty years of combined author experience as portfolio managers and financial advisors, Divorcing the Dow presents a timely framework for understanding and investing in market cycles. Authors Jim Troup and Sharon Michalsky believe that the Dow Jones Industrial Average is no longer a relevant indicator of market performance; in fact, they feel that watching the Dow may actually obscure indications that the financial markets are poised to experience a boom that dwarfs anything seen before. Based on in-depth research and field-tested in their own successful management of millions of dollars in personal and corporate assets, Divorcing the Dow introduces investors to a revolutionary paradigm for assessing the markets and making investment decisions. Troup and Michalsky's approach focuses on analyzing patterns of productivity as a way to anticipate market cycles and investment potential-and with this book they've outlined how investors can begin to recognize these patterns themselves. Divorcing the Dow provides investors with a new framework for thinking about financial markets and gives readers specific investment techniques to anticipate the market's direction and identify companies poised for sustained productivity and long-term growth. Jim Troup (Sarasota, FL) is First Vice President, Financial Consultant, Portfolio Manager, and Corporate Client Group Director at Smith Barney. A twenty-four-year finance veteran, Troup has worked with leading investment firms including E.F. Hutton and Merrill Lynch, and lectures extensively on portfolio management and asset allocation. SHARON MICHALSKY is First Vice President, Financial Consultant, Portfolio Manager, Corporate Client Group Director at Smith Barney, where she began her career nineteen years ago. She has attended The Wharton School and is the guest speaker at many professional forums where she lectures on investment methodology and portfolio management.

TrimTabs Investing. Using Liquidity Theory to Beat the Stock Market

Whether you are an investment professional managing billions of dollars or an individual investor with a small nest egg, TrimTabs Investing shows you how to beat the major stock market averages with less risk. This groundbreaking book begins by comparing the stock market to a casino in which the house (public companies and the insiders who run them) buys and sells shares with the players (institutional and individual investors). TrimTabs Investing argues that stock prices are primarily a function of liquidity—the amount of shares available for purchase and the amount of money available to buy them—rather than fundamental value. Finally, it outlines the building blocks of liquidity theory and explains how you can use them to predict the direction of the stock market. “Charles Biderman, a savvy and battle-scarred veteran of the investment wars, has fashioned an intriguing approach to making money in the stock market that adroitly avoids both heavy-breathing speculation and the standard Wall Street practices that enable investors, big and small, to lose money in good markets as well as bad. Aimed at the sophisticated investor (which may or may not be an oxymoron), the book is written in blessedly straightforward prose and is a worthwhile read for anyone with an urge to have a fling at investing.–Alan Abelson Barron’s “Since the days of Joseph and Pharaoh, it has been axiomatic that the size of the grain harvest affects the level of grain prices; but today’s investors have been slow to appreciate the fact that the supply of stock shares significantly determines the level of stock prices. Biderman’s long overdue book outlines the theory and evidence behind ‘Trading Float,’ the actual—and exploitable—power behind major moves in the stock market. –Paul Montgomery CEO and CIO of Montgomery Capital Management “‘Trade as corporate execs do, not as they say.’ Charles Biderman has built an impressive list of hedge fund clients from this essential insight, and this book does a great job explaining exactly how retail investors can incorporate it into their investing.” –Eric Zitzewitz Assistant Professor of Economics, Stanford Graduate School of Business “Charles Biderman is a smart thinker, clear writer—and he offers here some very interesting ideas. This book is for the little guy who enjoys reading about money and economics, even if he doesn’t adopt the strategies offered here; and for the professional or sophisticated investor, who, to a greater or lesser degree, just might.–Andrew Tobias author of The Only Investment Guide You'll Ever Need

Essential Technical Analysis. Tools and Techniques to Spot Market Trends

An Introduction to Technical Analysis from One of the Top Names in the Business «Essential Technical Analysis is a highly valued resource for technical traders. The importance of comprehensive and well-researched market behaviors, indicators, and systems were well expressed graphically with many examples. No technical analyst should be without this book. Stevens's book could become another classic.» -Suri Duddella, President of siXer.cOm, inc. (Forbes magazine's «Best of the Web» in Technical Analysis Category) «Essential Technical Analysis will give the new student of technical analysis a good overview of both classical chart patterns and a myriad of technical indicators, but so will many other texts. What sets this volume apart is that it presents the subject in the context of real-world trading situations, not idealized well-chosen examples. Books on technical analysis, especially those aimed at novices, are typically filled with charts in which the selected patterns are both unambiguous and work perfectly. As Leigh Stevens recognizes and confronts, however, the real world is a far more sloppy place: charts may often contain conflicting indicators, and patterns don't always work as described. Reading Essential Technical Analysis is like sitting beside a veteran technical analyst and having him describe his methods and market experiences.» -Jack Schwager, author of Market Wizards, Stock Market Wizards, and Schwager on Futures «Leigh Stevens's depth of experience, acquired over many years, has generated a deep understanding of, and commitment to, the discipline of technical analysis. He is also one of those rare individuals who have both the ability to convey the essence of his ideas in a wonderfully simple and straightforward way and through the use of personal anecdotes and experiences. There are not many people around who can both walk the walk and talk the talk.» -Tony Plummer, author of Forecasting Financial Markets, Director of Rhombus Research Ltd., and former Director of Hambros Bank Ltd. and Hambros Investment Management PLC «Leigh Stevens brings his considerable years of experience to this project. He has crafted a real-world book on technical analysis that gives you the benefit of his trials and errors as well as 120 years of observations and market wisdom from Charles Dow to the latest indicators and approaches. Investors who suffered from the bursting of the technology bubble in 1999 and 2000 should read Essential Technical Analysis from cover to cover and learn to apply the lessons to the next market cycle.» -Bruce M. Kamich, CMT, past President of the Market Technicians Association and Adjunct Professor of Finance at Rutgers University and Baruch College

Getting Even. The Truth About Workplace Revenge--And How to Stop It

Tripp and Bies educate employees and managers about the right and wrong ways to deal with workplace conflict, specifically revenge. The authors have amassed dozens of lively stories, insights and counter-intuitive truths to bring to the book. Not only will managers and employees find this information useful and entertaining, but most readers will find applications in their home lives as well as in their work lives. The core argument is that revenge is about justice. Avenging employees are not unprofessional, out-of-control employees; rather, they are victims of offenses who feel compelled to seek justice on their own. The authors address specific questions, such as: What kinds of offenses result in revenge? Why do some victims respond more aggressively to harm than others? What role does the organization play in how victims respond to offenses? What's the best advice for managers who wish to prevent their employees from seeking revenge? Most employees experience the desire for revenge, and are ready to settle their own scores at work when management won't enforce justice. This book offers a model that sequences avengers' thoughts and behaviors, from the beginning of the conflict to its end. The model is grounded in scientific research and organizes disparate findings into a whole.

Point, Click and Wow!. The Techniques and Habits of Successful Presenters

In Point, Click & Wow! you will find the insider knowledge of public speaking that we all need but were never taught. When Point, Click & Wow! was first published more than ten years ago, it quickly became the go-to resource for creating laptop presentations that have the «Wow» factor! Completely reworked and updated, this new third edition puts the focus on you, the presenter, who must create a winning presentation every time. Claudyne Wilder's groundbreaking book offers myriad new features and updated slide designs as well as illustrative stories and advice from executives. Note: CD-ROM/DVD and other supplementary materials are not included as part of eBook file.

Inside Volatility Arbitrage. The Secrets of Skewness

Today?s traders want to know when volatility is a sign that the sky is falling (and they should stay out of the market), and when it is a sign of a possible trading opportunity. Inside Volatility Arbitrage can help them do this. Author and financial expert Alireza Javaheri uses the classic approach to evaluating volatility – time series and financial econometrics – in a way that he believes is superior to methods presently used by market participants. He also suggests that there may be «skewness» trading opportunities that can be used to trade the markets more profitably. Filled with in-depth insight and expert advice, Inside Volatility Arbitrage will help traders discover when «skewness» may present valuable trading opportunities as well as why it can be so profitable.