John Wiley & Sons Limited (USD)

Все книги издательства John Wiley & Sons Limited (USD)Starting an Online Business All-in-One Desk Reference For Dummies

If you’ve thought of starting an online business or if you’re already selling online, here’s how to get your share of online customers. This second edition of Starting an Online Business All-in-One For Dummies covers everything from creating a business plan and building a customer-friendly site to marketing with Facebook and MySpace. There’s even a section about setting up shop in the virtual world of Second Life. Eleven handy minibooks cover online business basics, legal and accounting, Web site design, online and operating, Internet security, boosting sales, retail to e-tail, storefront selling, fundraising sites, niche e-commerce, and e-commerce advanced. You’ll learn to: Build a business plan that translates your ideas into a profitable enterprise Choose software to help you manage taxes, balance sheets, and other accounting chores Create a Web site that helps your business make money Fill orders, pack and ship merchandise, and manage stock Set up, budget for, and implement a plan to protect vital computer equipment Use PR and advertising tools that best promote your business online, including Google AdWords Choose what sells best in Second Life and earn real money from your virtual store Market through niche communities, find and use special marketing tools for nonprofit organizations, and apply successful mobile marketing techniques Inside the book, you’ll even find a Google AdWords gift card worth $25 to help spread the word about your online business!

Risk Management for Islamic Banks

Gain insight into the unique risk management challenges within the Islamic banking system Risk Management for Islamic Banks: Recent Developments from Asia and the Middle East analyzes risk management strategies in Islamic banking, presented from the perspectives of different banking institutions. Using comprehensive global case studies, the book details the risks involving various banking institutions in Indonesia, Malaysia, UAE, Bahrain, Pakistan, and Saudi Arabia, pointing out the different management strategies that arise as a result of Islamic banking practices. Readers gain insight into risk management as a comprehensive system, and a process of interlinked continuous cycles that integrate into every business activity within Islamic banks. The unique processes inherent in Islamic banking bring about complex risks not experienced by traditional banks. From Shariah compliance, to equity participation contracts, to complicated sale contracts, Islamic banks face unique market risks. Risk Management for Islamic Banks covers the creation of an appropriate risk management environment, as well as a stage-based implementation strategy that includes risk identification, measurement, mitigation, monitoring, controlling, and reporting. The book begins with a discussion of the philosophy of risk management, then delves deeper into the issue with topics like: Risk management as an integrated system The history, framework, and process of risk management in Islamic banking Financing, operational, investment, and market risk Shariah compliance and associated risk The book also discusses the future potential and challenges of Islamic banking, and outlines the risk management pathway. As an examination of the wisdom, knowledge, and ideal practice of Islamic banking, Risk Management for Islamic Banks contains valuable insights for those active in the Islamic market.

Bank Asset and Liability Management

Hong Kong Institute of Bankers (HKIB)

An in-depth look at how banks and financial institutions manage assets and liabilities Created for banking and finance professionals with a desire to expand their management skillset, this book focuses on how banks manage assets and liabilities, set up governance structures to minimize risks, and approach such critical areas as regulatory disclosures, interest rates, and risk hedging. It was written by the experts at the world-renowned Hong Kong Institute of Bankers, an organization dedicated to providing the international banking community with education and training. Explains bank regulations and the relationship with monetary authorities, statements, and disclosures Considers the governance structure of banks and how it can be used to manage assets and liabilities Offers strategies for managing assets and liabilities in such areas as loan and investment portfolios, deposits, and funds Explores capital and liquidity, including current standards under Basel II and Basel III, funding needs, and stress testing Presents guidance on managing interest rate risk, hedging, and securitization

CFA Program Curriculum 2019 Level II Volumes 1-6 Box Set

Master the practical aspects of the CFA Program curriculum with expert instruction for the 2019 exam The same official curricula that CFA Program candidates receive with program registration is now publicly available for purchase. CFA Program Curriculum 2019 Level II, Volumes 1-6 provides the complete Level II curriculum for the 2019 exam, with practical instruction on the Candidate Body of Knowledge (CBOK) and how it is applied, including expert guidance on incorporating concepts into practice. Level II focuses on complex analysis with an emphasis on asset valuation, and is designed to help you use investment concepts appropriately in situations analysts commonly face. Coverage includes ethical and professional standards, quantitative analysis, economics, financial reporting and analysis, corporate finance, equities, fixed income, derivatives, alternative investments, and portfolio management organized into individual study sessions with clearly defined Learning Outcome Statements. Charts, graphs, figures, diagrams, and financial statements illustrate complex concepts to facilitate retention, and practice questions with answers allow you to gauge your understanding while reinforcing important concepts. While Level I introduced you to basic foundational investment skills, Level II requires more complex techniques and a strong grasp of valuation methods. This set dives deep into practical application, explaining complex topics to help you understand and retain critical concepts and processes. Incorporate analysis skills into case evaluations Master complex calculations and quantitative techniques Understand the international standards used for valuation and analysis Gauge your skills and understanding against each Learning Outcome Statement CFA Institute promotes the highest standards of ethics, education, and professional excellence among investment professionals. The CFA Program curriculum guides you through the breadth of knowledge required to uphold these standards. The three levels of the program build on each other. Level I provides foundational knowledge and teaches the use of investment tools; Level II focuses on application of concepts and analysis, particularly in the valuation of assets; and Level III builds toward synthesis across topics with an emphasis on portfolio management.

CFA Program Curriculum 2019 Level I Volumes 1-6 Box Set

Clear, concise instruction for all CFA Program Level I concepts and competencies for the 2019 exam The same official curricula that CFA Program candidates receive with program registration is now publicly available for purchase. CFA Program Curriculum 2019 Level I, Volumes 1-6 provides the complete Level I curriculum for the 2019 exam, delivering the Candidate Body of Knowledge (CBOK) with expert instruction on all 10 topic areas of the CFA Program. Fundamental concepts are explained in-depth with a heavily visual style, while cases and examples demonstrate how concepts apply in real-world scenarios. Coverage includes ethical and professional standards, quantitative analysis, economics, financial reporting and analysis, corporate finance, equities, fixed income, derivatives, alternative investments, and portfolio management, all organized into individual sessions with clearly defined Learning Outcome Statements. Charts, graphs, figures, diagrams, and financial statements illustrate concepts to facilitate retention, and practice questions provide the opportunity to gauge your understanding while reinforcing important concepts. Learning Outcome Statement checklists guide readers to important concepts to derive from the readings Embedded case studies and examples throughout demonstrate practical application of concepts Figures, diagrams, and additional commentary make difficult concepts accessible Practice problems support learning and retention CFA Institute promotes the highest standards of ethics, education, and professional excellence among investment professionals. The CFA Program curriculum guides you through the breadth of knowledge required to uphold these standards.

CFA Program Curriculum 2019 Level III Volumes 1-6 Box Set

Apply CFA Program concepts and skills to real-world wealth and portfolio management for the 2019 exam The same official curricula that CFA Program candidates receive with program registration is now publicly available for purchase. CFA Program Curriculum 2019 Level III, Volumes 1-6 provides complete, authoritative guidance on synthesizing the entire CFA Program Candidate Body of Knowledge (CBOK) into professional practice for the 2019 exam. This book helps you bring together the skills and concepts from Levels I and II to formulate a detailed, professional response to a variety of real-world scenarios. Coverage spans all CFA Program topics and provides a rigorous treatment of portfolio management, all organized into individual study sessions with clearly defined Learning Outcome Statements. Visual aids clarify complex concepts, and practice questions allow you to test your understanding while reinforcing major content areas. Levels I and II equipped you with foundational investment tools and complex analysis skill; now, you'll learn how to effectively synthesize that knowledge to facilitate effective portfolio management and wealth planning. This study set helps you convert your understanding into a professional body of knowledge that will benefit your clients' financial futures. Master essential portfolio management and compliance topics Synthesize your understanding into professional guidance Reinforce your grasp of complex analysis and valuation Apply ethical and professional standards in the context of real-world cases CFA Institute promotes the highest standards of ethics, education, and professional excellence among investment professionals. The CFA Program curriculum guides you through the breadth of knowledge required to uphold these standards. The three levels of the program build on each other. Level I provides foundational knowledge and teaches the use of investment tools; Level II focuses on application of concepts and analysis, particularly in the valuation of assets; and Level III builds toward synthesis across topics with an emphasis on portfolio management.

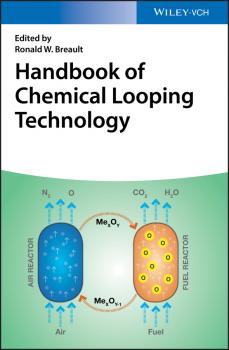

Handbook of Chemical Looping Technology

This comprehensive and up-to-date handbook on this highly topical field, covering everything from new process concepts to commercial applications. Describing novel developments as well as established methods, the authors start with the evaluation of different oxygen carriers and subsequently illuminate various technological concepts for the energy conversion process. They then go on to discuss the potential for commercial applications in gaseous, coal, and fuel combustion processes in industry. The result is an invaluable source for every scientist in the field, from inorganic chemists in academia to chemical engineers in industry.

Flexible Carbon-based Electronics

This third volume in the Advanced Nanocarbon Materials series covers the topic of flexible electronics both from a materials and an applications perspective. Comprehensive in its scope, the monograph examines organic, inorganic and composite materials with a section devoted to carbon-based materials with a special focus on the generation and properties of 2D materials. It also presents carbon modifications and derivatives, such as carbon nanotubes, graphene oxide and diamonds. In terms of the topical applications covered these include, but are not limited to, flexible displays, organic electronics, transistors, integrated circuits, semiconductors and solar cells. These offer perspectives for today?s energy and healthcare challenges, such as electrochemical energy storage and wearable devices. Finally, a section on fundamental properties and characterization approaches of flexible electronics rounds off the book. Each contribution points out the importance of the structure-function relationship for the target-oriented fabrication of electronic devices, enabling the design of complex components.

Taschenbuch für den Tunnelbau 2019

Deutsche Gesellschaft für Geotechnik e.V. / German Geotechnical Society

Das Taschenbuch für den Tunnelbau ist seit vielen Jahren ein praxisorientierter Ratgeber für Auftraggeber, Planer und Bauausführende. Es greift aktuelle Entwicklungen und Problemstellungen auf, präsentiert innovative Lösungen und dokumentiert dabei den jeweils erreichten Stand der Technik. Die Beiträge in der Ausgabe 2019 behandeln die Themenbereiche Konventioneller bergmännischer Tunnelbau, maschineller Tunnelbau, Digitalisierung im Tunnelbau, Baustoffe und Bauteile sowie Vertragswesen, Wirtschaftlichkeit und Akzeptanz. Die Rubrik Digitalisierung im Tunnelbau wird ab Ausgabe 2019 neu eingeführt und erhält u.a. zwei Beiträge zur Anwendung von BIM im Tunnelbau. Ein Einkaufsführer zum Thema Tunnelbaubedarf rundet das Buch ab